The First Decentralized Crypto Time-Locking Protocol

Protect gains from emotional decisions.

- Pre Sell

- Soft Cap

- Bonus

65% target raised 1 ETH = $1000 = 3177.38 CIC

Fairlaunch on GemPad Starts Soon

Fairlaunch on GemPad Starts Soon

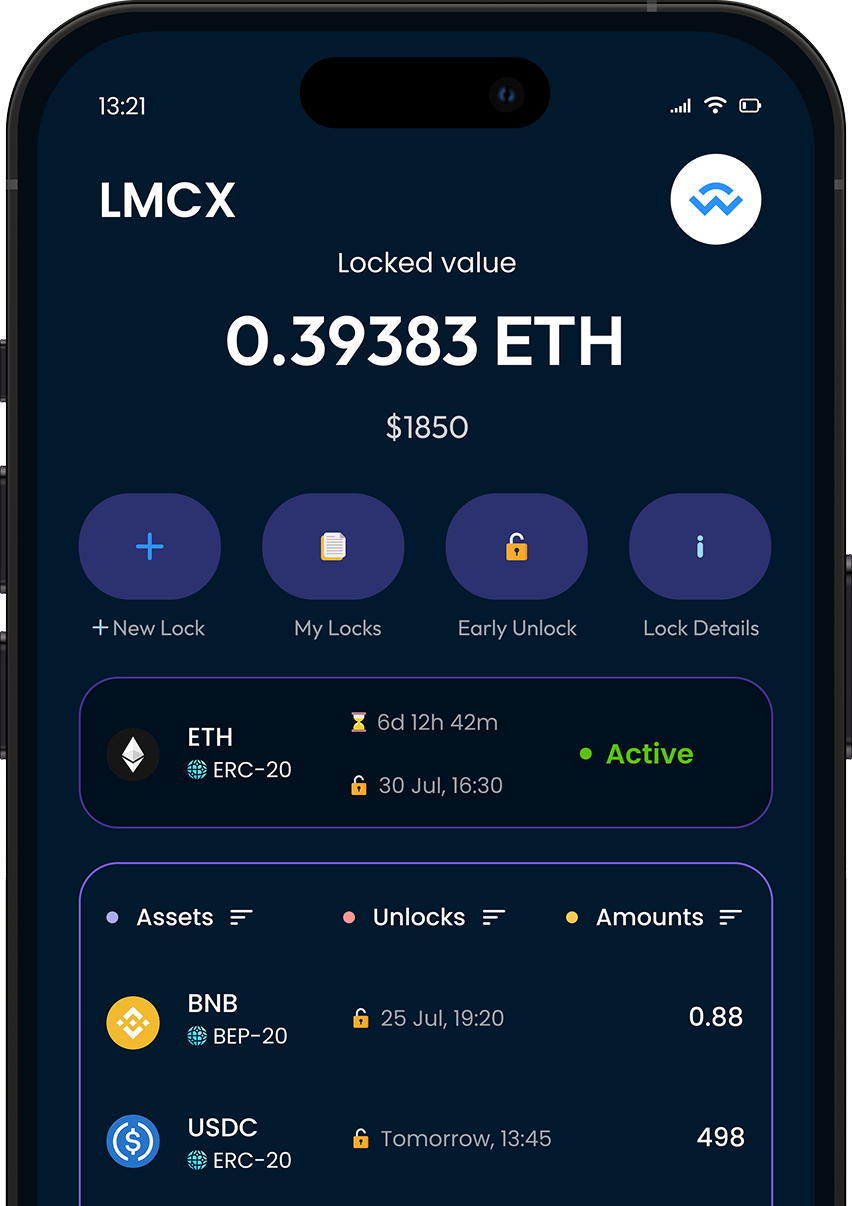

We build a simple on-chain tool

For gamblers, traders, and investors

Lock crypto by time or by price

Delay access to protect their gains

Turn emotions into calm decisions

Set your terms. Lock it in.

LMCX is the fuel of the protocol

Every lock pays a small LMCX fee

Part of every fee is burned forever

Part funds the treasury for growth

Locks increase scarcity as use grows

More locks. Rarer LMCX.![]()

why Choose LMCX Protocol

Behavioral Locks

Lock assets by time or price to protect gains from impulsive decisions and stay in control when emotions hit. A simple way to build stronger habits.

Dynamic Burn

Each lock fuels the burn engine and treasury, creating real scarcity as adoption grows. The more users lock, the stronger the ecosystem gets.

Decentralized Core

No custody and no admin keys. Smart contracts secure your funds on-chain with full transparency and zero central control.

Flexible Settings

Set your own limits — choose full locks for strict discipline or flexible locks with early unlocks for a small fee. Designed for real-world use.

Trading &

Gambling Friendly

Built for high-impulse markets where quick decisions can cost you. Delay access to your funds to avoid compulsive decisions and protect your earnings.

Future-Ready

Platform

Supports EVM tokens, stablecoins, and future native assets for seamless cross-chain growth. Scalable architecture built to evolve with the market.

Audited &

Transparent

Independent audits, locked LP, and vested team tokens ensure fairness and long-term trust. Everything verifiable, nothing hidden.

Escrow &

Corporate Locks

Escrow for deals, LP, and team-token locks for projects — secure, on-chain control for every use case. Enterprise-level reliability made simple.

Locks without limits

Most DeFi protocols stop at EVM tokens. LMCX goes further, letting you time-lock native assets like BTC, XRP, and SOL, along with EVM tokens such as ETH, BNB, and stablecoins USDT and USDC directly on-chain. No custody, no trust gaps. Pure on-chain control, built for a multichain future.

Be part of the first protocol to lock any asset, anywhere.

Our Chain Support

From Bitcoin to Ethereum, and beyond.

Smart Fees & Adaptive Burn

Lower fees for bigger locks. Burn shifts to treasury as adoption grows.

Protocol Fee by Lock Size

| Lock Size (USD) | Fee % |

|---|---|

| $50 – $300 | 3.0% |

| $301 – $1 000 | 2.5% |

| $1 001 – $5 000 | 2.0% |

| $5 001 – $25 000 | 1.0% |

| $25 001 – $100 000 | 0.7% |

| $100 001 – $500 000 | 0.5% |

| $500 001 – $1 000 000 | 0.3% |

| Above $1 M | 0.2% |

Minimum lock: $50 USD equivalent. Fees are charged in the asset you lock — no LMCX needed to lock.

Burn / Treasury Split by TVL

| Monthly TVL Locked | Burn % | Treasury % |

|---|---|---|

| < $1 M | 50% | 50% |

| $1 M – $2 M | 45% | 55% |

| $2 M – $5 M | 40% | 60% |

| $5 M – $10 M | 35% | 65% |

| $10 M – $25 M | 30% | 70% |

| $25 M – $50 M | 25% | 75% |

| $50 M – $100 M | 20% | 80% |

| > $100 M | 10% | 90% |

Live burn ratio adjusts as TVL grows — stronger burn early, more treasury at scale.

Current figures reflect the initial model and may be refined during development. Final fee and burn settings will be published before mainnet launch.

Read LMCX

Documents

- White Paper

- One Pager

- Terms Of Coin Sale

- Contract & Treasury Info

Strategy & Vision

Foundation

•⠀Launch LMCX fair sale via GemPad.app •⠀Release landing page with live protocol visuals & token info •⠀Begin protocol development (time-lock engine + burn logic) •⠀Start pre-launch marketing campaigns & community growthCore Protocol

•⠀Deploy Ethereum & BSC time-lock contracts •⠀Launch first version of the DApp with real-time burn & TVL dashboard •⠀Start multichain research & architecture planning •⠀Kick off influencer and media campaignsFeatures & Multichain

•⠀Add additive locking & first bonus reward system •⠀Expand support to additional EVM-compatible chains •⠀Publish transparency feed with on-chain metrics •⠀Begin limited testing of native asset locksUtility Deepening

•⠀Release advanced multichain management tools •⠀Refine mobile dashboard for speed & usability •⠀Launch escrow module demo for community review •⠀Open API access for third-party integrationsMaturity

•⠀Launch fully decentralized escrow service •⠀Expand API adoption through developer outreach •⠀Grow global marketing presence and brand recognition •⠀Strengthen infrastructure for high-volume locksSustainability

•⠀Roll out full native locking for Bitcoin, SOL, XRP, and more •⠀Enhance performance & cross-chain compatibility •⠀Grow international adoption with localized campaigns •⠀Develop advanced behavioral finance tools for all usersFair From Day One

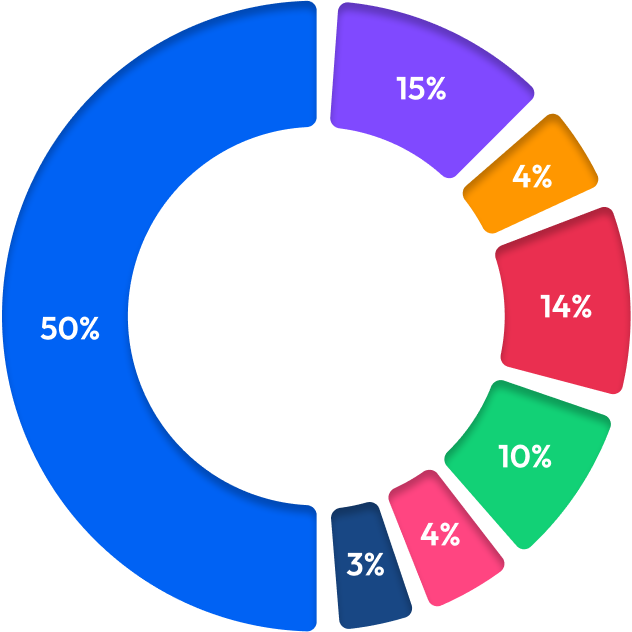

LMCX starts fair and stays fair, with public-first distribution and real protocol utility driving long-term value.

Total Supply: 1,000,000,000 LMCX

We’re launching with a 100% fair model — no presale, no VC unlocks, no insider deals. 50% of all tokens go directly to the public, and 51% of raised BNB is locked as liquidity. Our protocol is deflationary by design: every lock burns $LMCX and powers the ecosystem.

The more it’s used — the rarer it becomes.

- Fairlaunch – 50%

- Team (Vested) – 15%

- Core Development – 14%

- UX/UI & Protocol Analytics – 4%

- Marketing & Promotions – 10%

- CEX & Expansion – 4%

- Community Incentives – 3%

Team tokens are vested over 12 months.

Team tokens are vested over 12 months. Built for the community, not insiders.

Built for the community, not insiders. The Leadership Team

Behind Every Lock — A Team That Knows the Game.

Reinis Kreicbergs

Co-Founder & Strategy LeadDrives product vision, user behavior logic, and launch strategy.

Valdis Strautins

Co-Founder & Technical LeadLeads smart contract development and multichain architecture.

Einars Melderis

Project ManagerOversees cross-team communication and supports technical execution.

Talk to the Lock Keepers

Partnerships, questions, feedback—drop us a note.